Legal Disclaimer: At Everlight Solar, we are solar experts, not tax experts! Tax codes are complicated, so consult your tax advisor before deciding what is best for you. If you have questions regarding your Federal Investment Tax Credit or IRS Form 5695, do not refer questions to your Energy Consultant or Everlight Solar. Rather, you should discuss your situation with your CPA or other qualified tax advisors. Everlight Solar is not responsible for or liable for any errors or omissions in regards to your personal tax and finance situation or obligations. The following is for informational purposes only, and should not be considered instructions or legal advice.

If you have been researching solar, you have most likely come across the Investment Tax Credit (ITC) from the federal government, which helps homeowners and businesses go solar at a more affordable rate by offering a tax deduction equal to 30% of the total cost of a solar system.

This means if your solar system costs $54,054, the solar panel tax credit can reduce your federal tax burden by $16,216.20. This is just one of the many incentives in place that can reduce the solar cost for homeowners and businesses. This is a guide to help you actually claim the ITC on your taxes.

ELIGIBILITY

To be eligible for the Federal ITC, you must own your solar system. If you have a lease agreement, the third-party owner gets the tax credit for that system. If the home that you want a solar system for is not your primary residence, you are still eligible for the tax credit as long as you own the property and it is not a rental. Here is a quote from the U.S. Department of Energy guide:

“Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48.11”

Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics – U.S. Department of Energy

The other piece of eligibility is knowing your federal tax liability. If this is lower than your ITC savings, you will be able to carry over the remaining credits to the following year. For example, using our $54,054 system example, you are eligible for $16,216.20 ITC. If your federal tax liability for 2022 is only $10,000, you will owe no federal taxes that year, and in 2023, you will be able to use the extra $6,216.20 to reduce your tax liability.

IRS Form 5695

To claim the ITC, all you must do is fill out the IRS Form 5695 “Residential Energy Credits” and include your result on your IRS Schedule 3 (Form 1040).

Form 5695 is used for a variety of qualified residential energy improvements. We are going to be using a solar example, obviously.

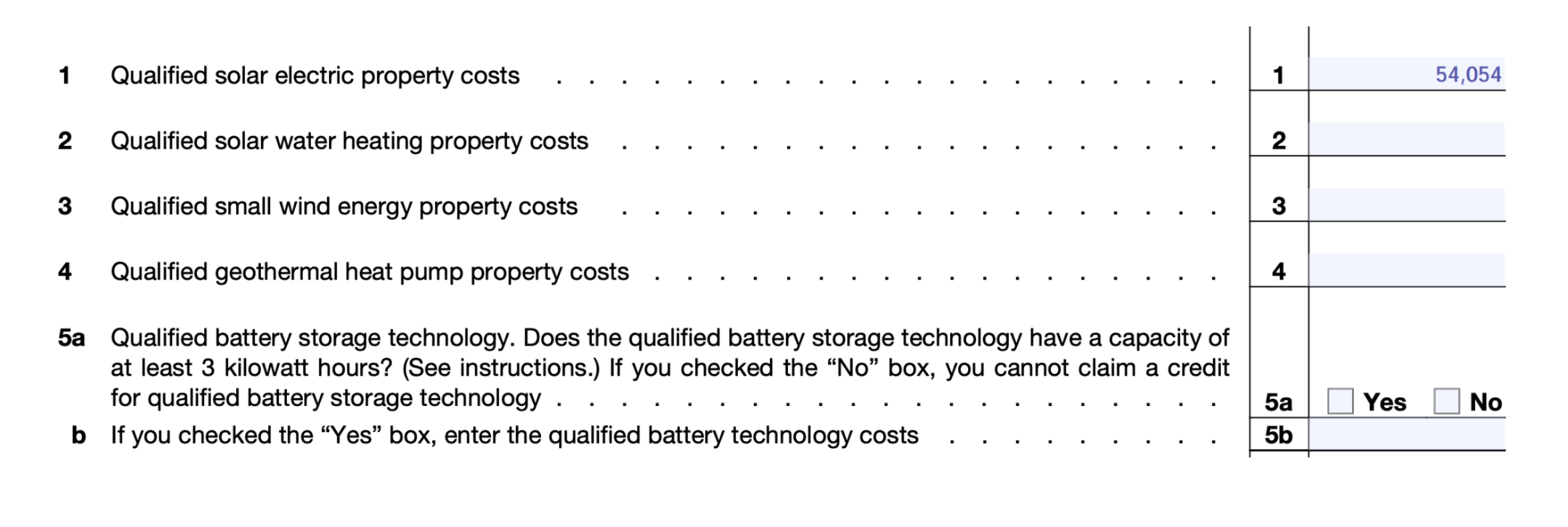

First, you need to know the gross cost of your solar system after any cash rebates. This goes on line 1. Include any additional improvements, if any, on lines 2 through 5.

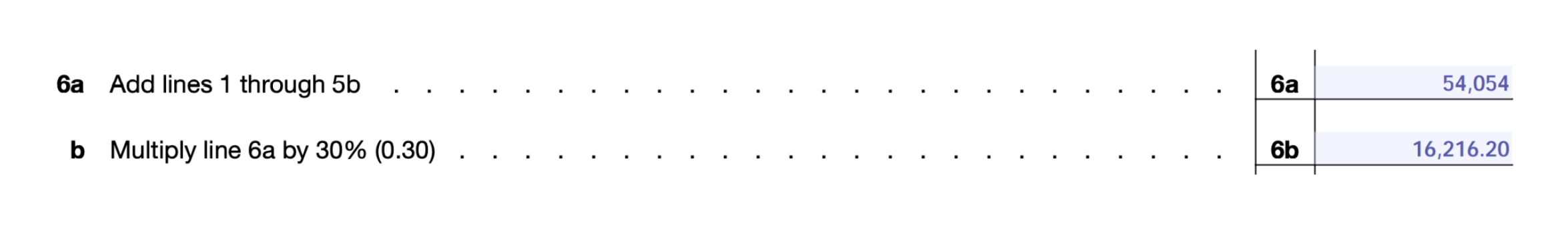

On line 6b, multiply line 6a by 30%.

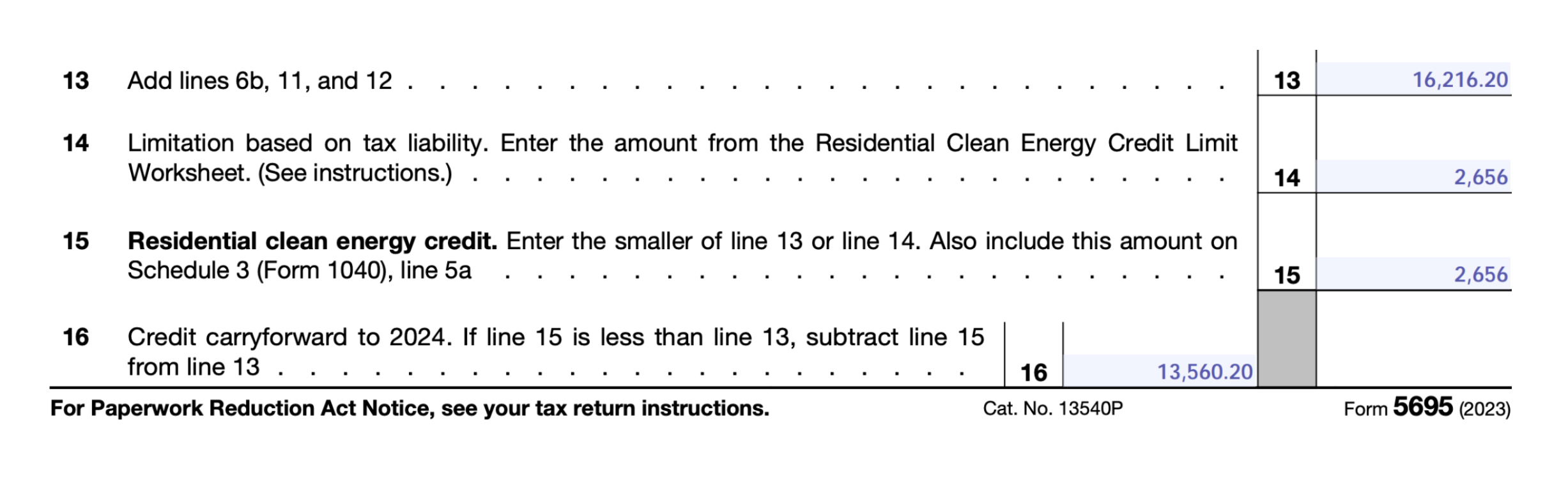

If you are carrying forward any credits from last year, you would skip to line 12 and insert the amount there. If not, you will put the amount from line 6b to line 13.

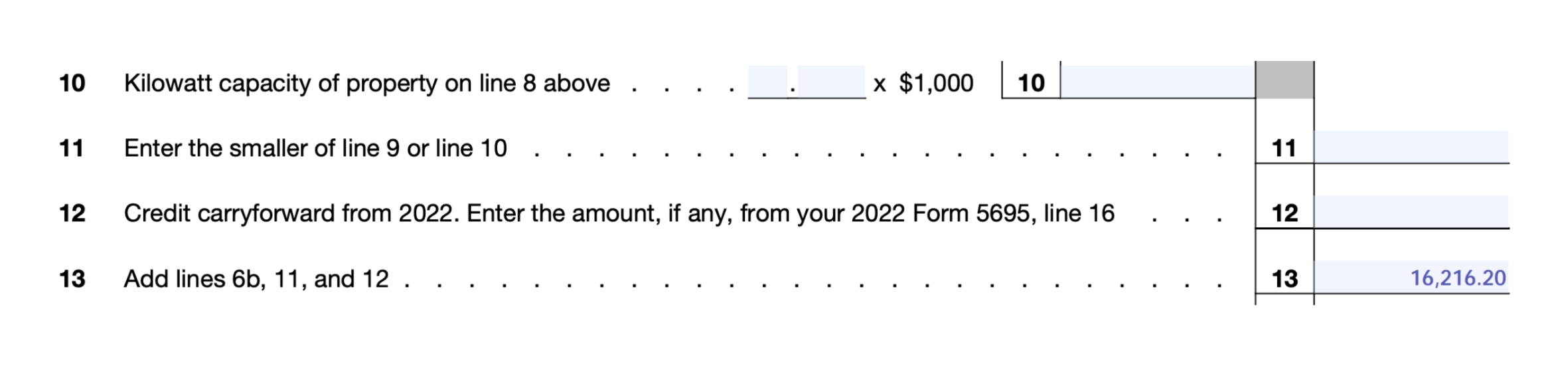

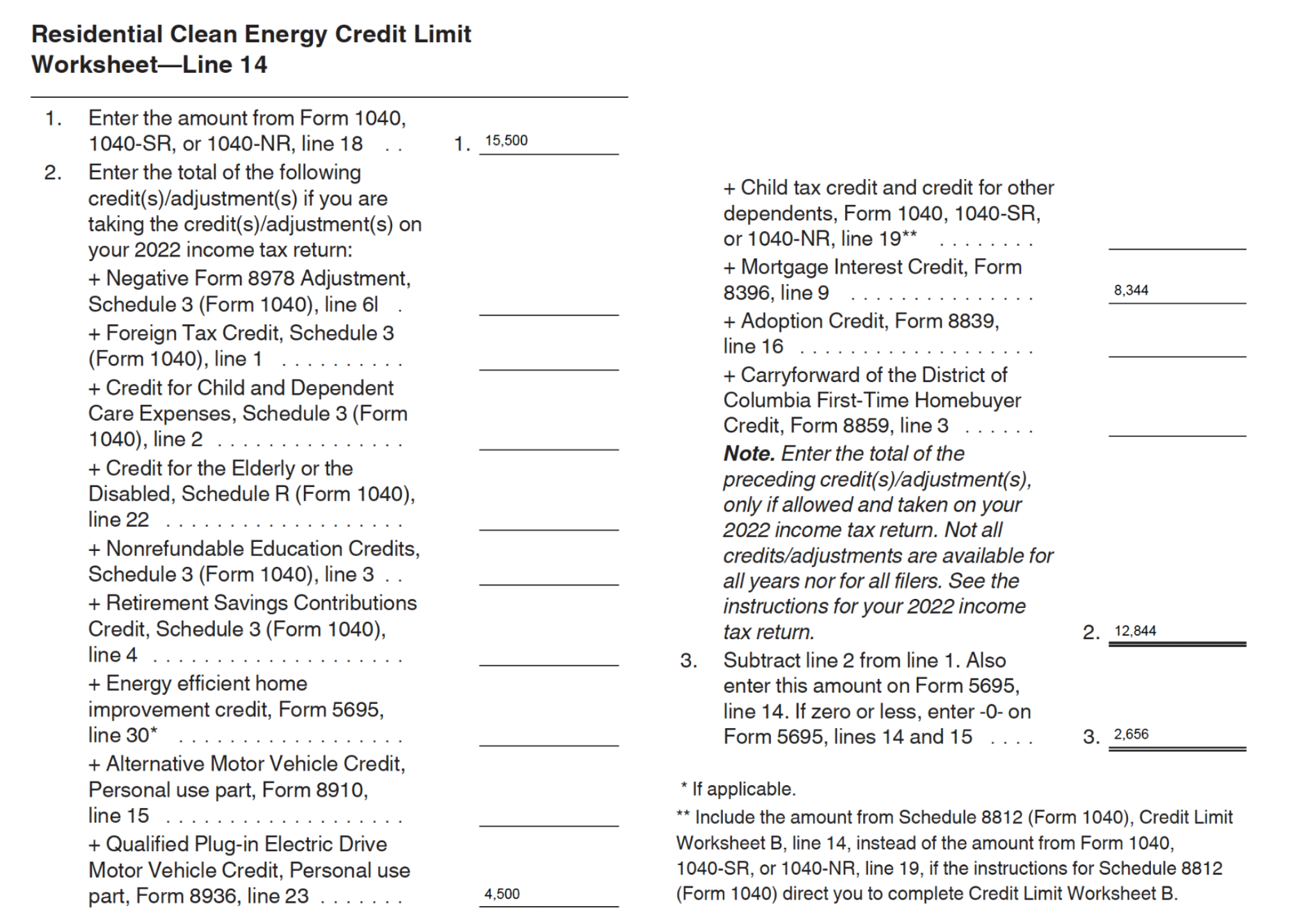

Next, complete the “Residential Energy Efficient Property Credit Limit Worksheet” on page 4 to calculate if you have enough tax liability to get all 30% in one year. You will need all the tax credits that you are claiming here.

In this example, we will fill in amounts to show how the worksheet totals. Be sure that you use your own numbers to complete this worksheet for yourself.

Enter the result on line 14 of Form 5695. Review line 13 and line 14, and put the smaller of the two values on line 15. If your tax liability is smaller than your tax credits, subtract line 15 from line 13, and enter it on line 16.

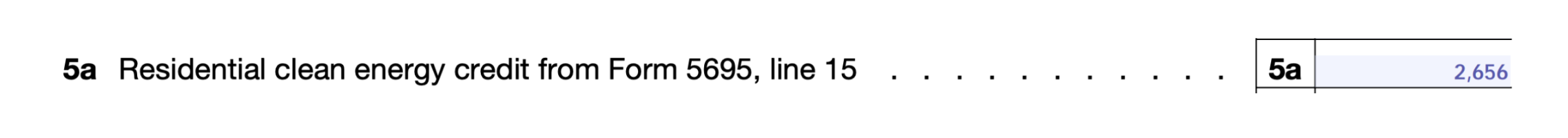

The value on line 15 is the amount that will be credited on your taxes this year. Enter that value into Schedule 3 (Form 1040), line 5a.

These steps have outlined what you need to do to have 30% of the cost of your solar panel system credited back to you! If you did additional energy efficiency improvements to your home in the same year, you may also need to complete page 2 of Form 5695.

Be sure to include Form 5695 when you submit your taxes to the IRS.