Customer Support

We’re here to help

Contact Us

Contact us using one of the methods listed, or browse topics below to find answers.

General Troubleshooting

My panels are reading “NC”

Federal Tax Incentives

Please note: At Everlight Solar, we are solar experts, not tax experts! Tax codes are complicated, so consult your tax advisor before deciding what is best for you. If you have questions regarding your Federal Investment Tax Credit or IRS Form 5695, do not refer questions to your Energy Consultant or Everlight Solar. Rather, you should discuss your situation with your CPA or other qualified tax advisor. Everlight Solar is not responsible for or liable for any errors or omissions in regards to your personal tax and finance situation or obligations.

How do I get the Federal Tax Incentive for my solar panels?

As you prepare your taxes you’ll want a copy of your purchase agreement.

There’s plenty of information out there about the value of the residential ITC, but figuring out how to actually claim the credit when it comes time to file your taxes is another story. We’ll walk you through the instructions step by step from Form 5695 to Form 1040. Find specific information on this web page: https://www.irs.gov/forms-pubs/about-form-5695

Form 5695 Instructions: The 3 steps to claim the solar tax credit

- Determine if you are eligible for the Federal ITC

- Complete IRS Form 5965 to validate your qualification for renewable energy credits

- Add your renewable energy credit information to your typical form 1040

Additional Solar Energy Resources

Warranties

Longi 355

Solar Panels

Download PDF

Silfab 370

Solar Panels

Download PDF

Heliene 300

Solar Panels

Download PDF

Silfab 360

Solar Panels

Download PDF

Mission 345

Solar Panels

Download PDF

Silfab 330

Solar Panels

Download PDF

Q Cells 400

Solar Panels

Download PDF

Silfab 320

Download PDF

Solar4America 410

Solar Panels

Download PDF

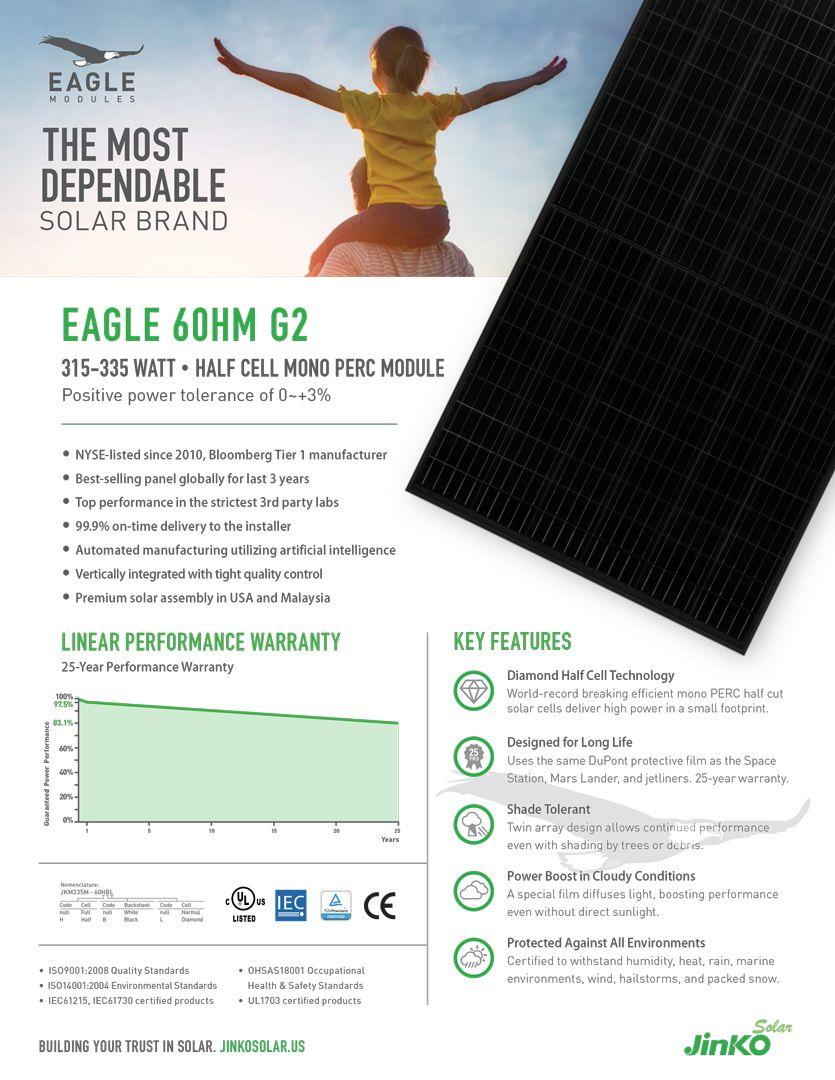

Eagle 60HM G2 320

Solar Panels

Download PDF

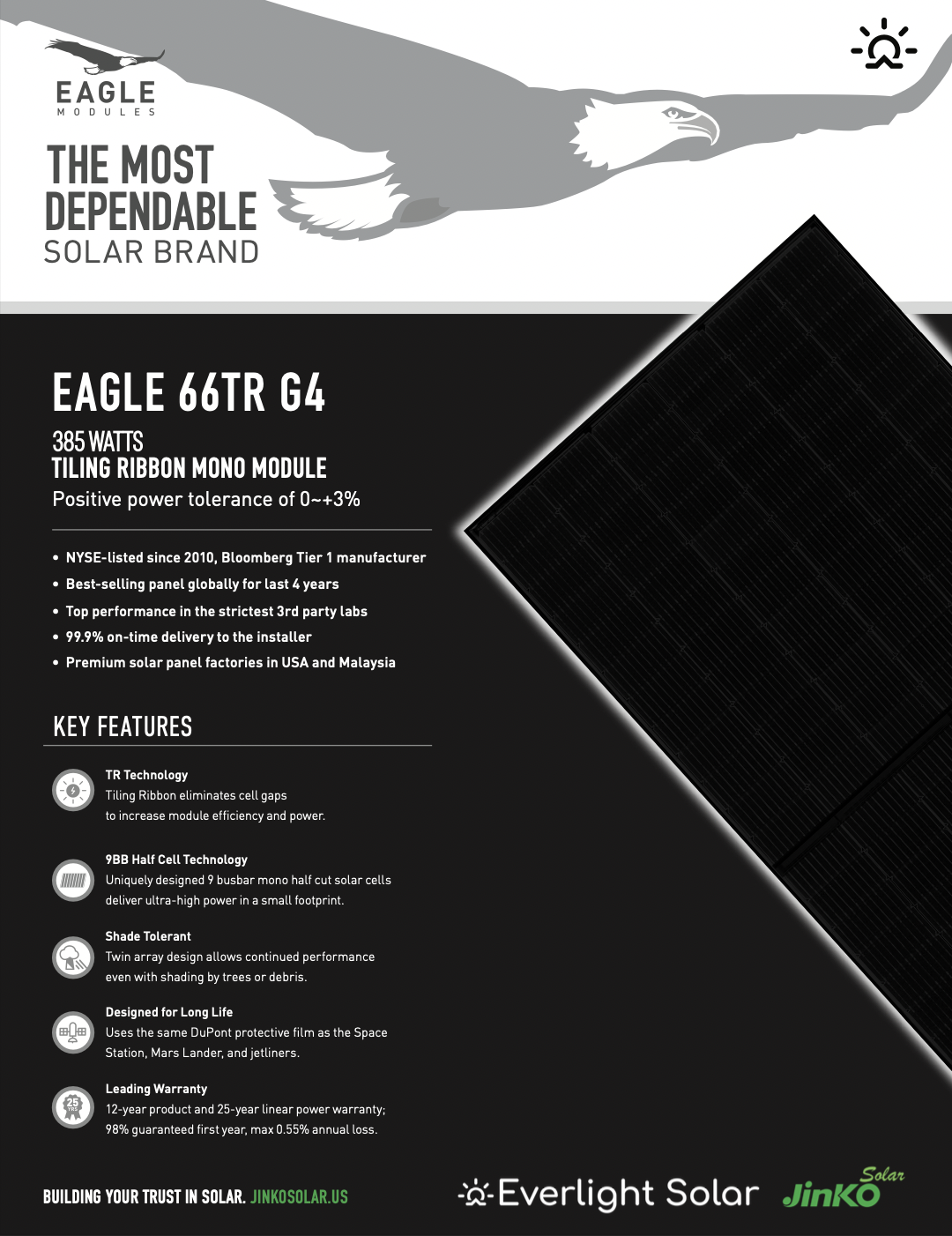

Eagle 385

Solar Panels

Download PDF

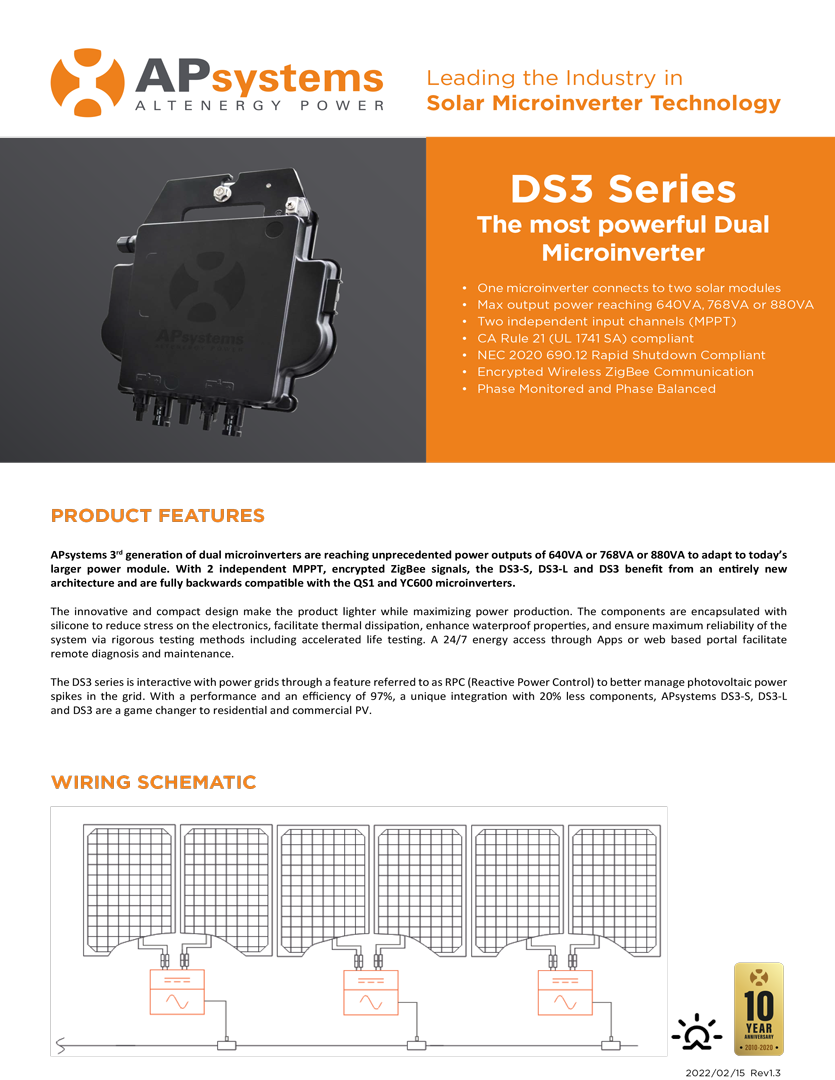

APSystems DS3 Series

Microinverter

Download PDF

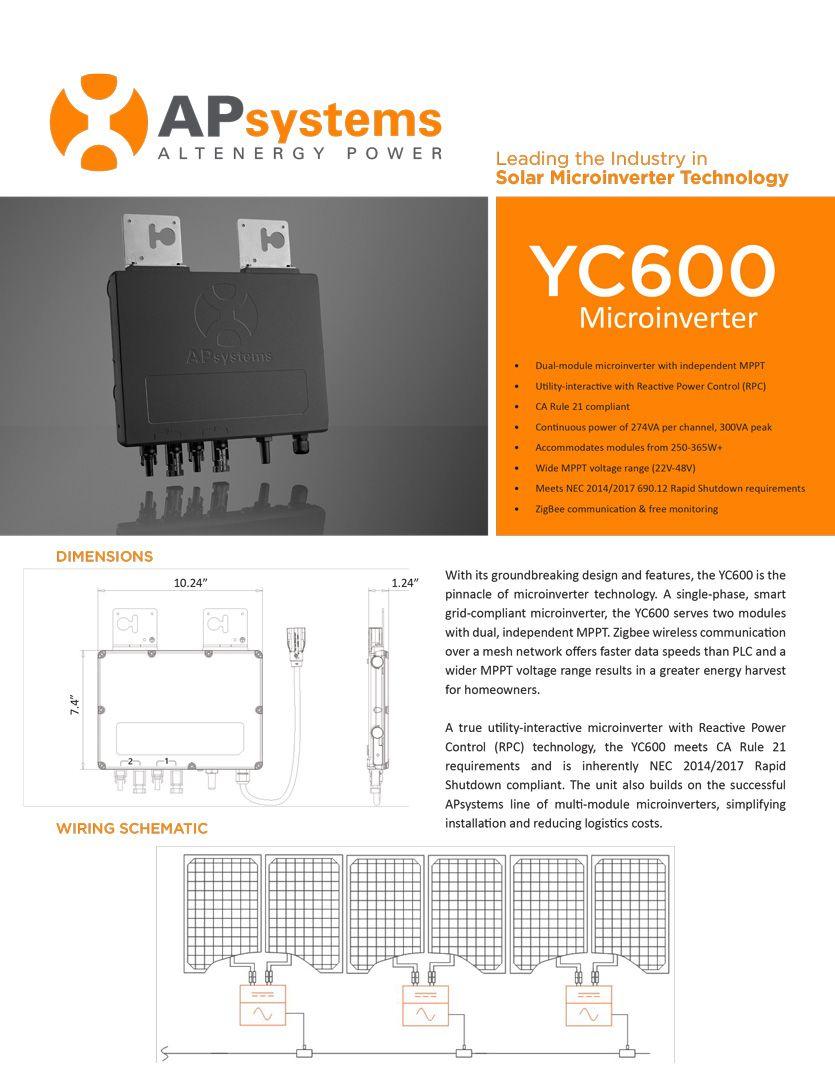

APSystems YC600

Download PDF

APSystems QS1

Download PDF

Warranties

Silfab 370

Solar Panels

Download PDF

Heliene 300

Solar Panels

Download PDF

Silfab 360

Solar Panels

Download PDF

Mission 345

Solar Panels

Download PDF

Silfab 330

Solar Panels

Download PDF

Q Cells 400

Solar Panels

Download PDF

Silfab 320

Download PDF

Eagle 385

Solar Panels

Download PDF

Eagle 60HM G2 320

Solar Panels

Download PDF

APSystems DS3 Series

Microinverter

Download PDF

APSystems QS1

Download PDF

Solar4America 410

Solar Panels

Download PDF

APSystems YC600

Download PDF

Other Helpful Links

Solar Billing Information

Download PDF

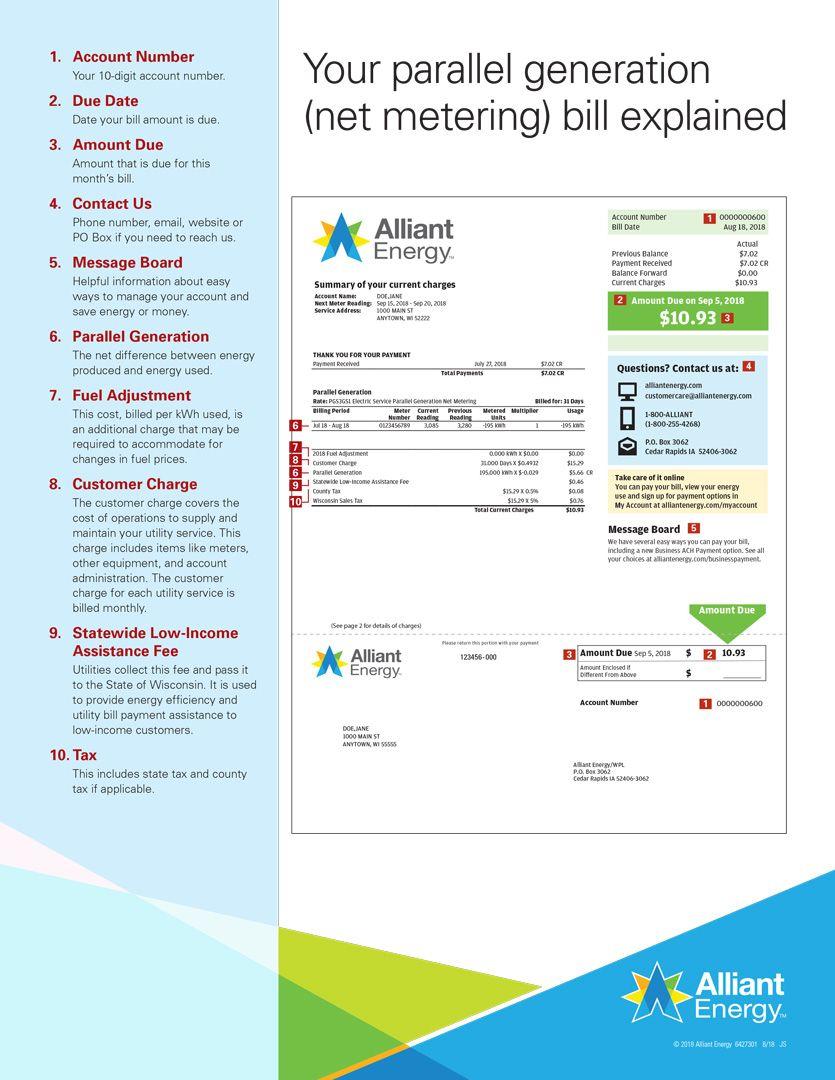

Your Net Metering Bill Explained

Download PDF